This indicator doesn't draw the Keltner bands to help maintain a clean chart for those who don't like to plot indicators (naked charting) and there are already free indicators that do that.

This indicator has only been used on the ES and MES so it has been limited to those instruments only. For other instruments check out the ATR based stop indicator here

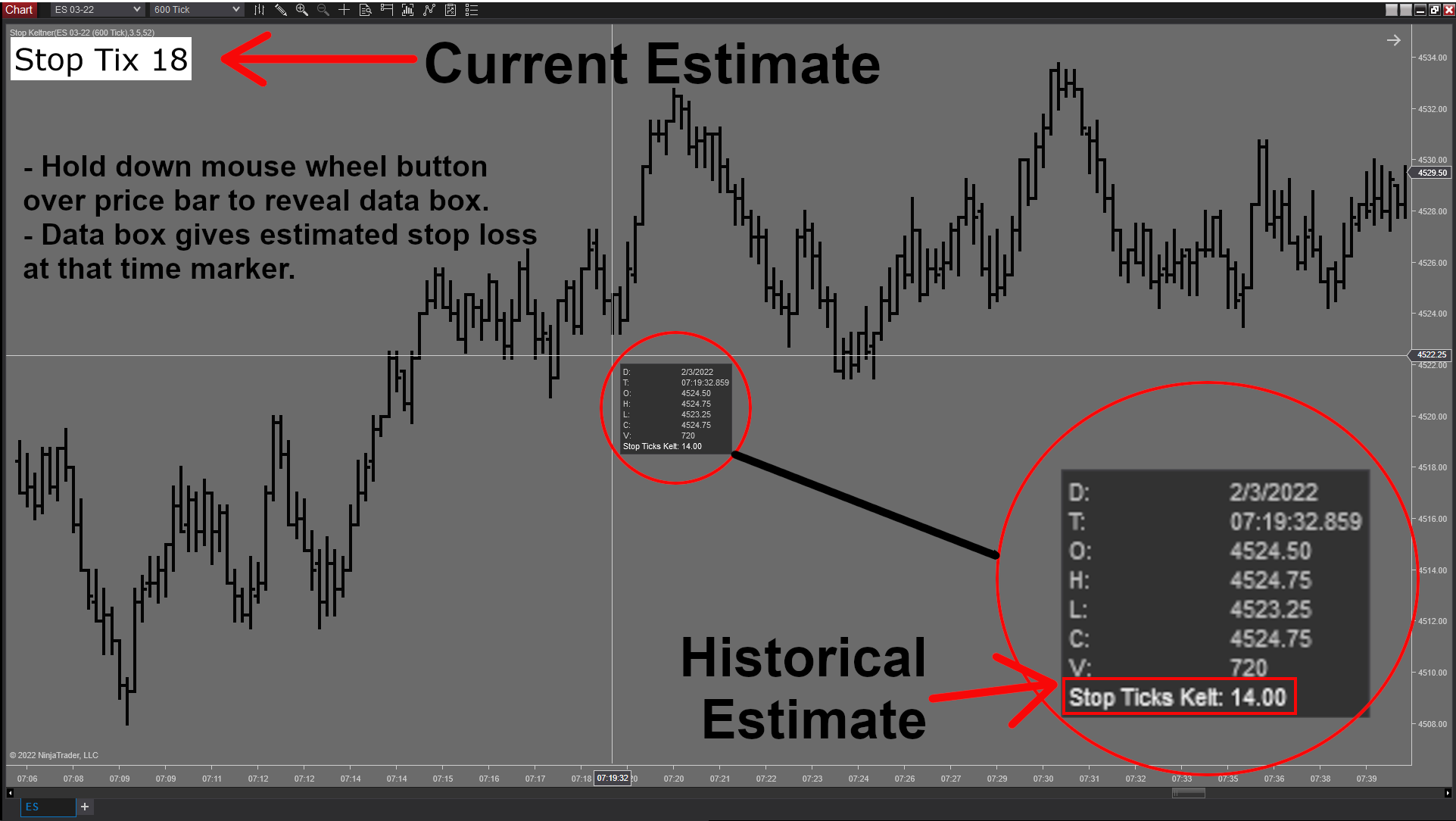

As an added bonus this indicator is an excellent backtesting tool for quickly getting estimated stops when identifying past trade entries on historical bars. The user can navigate to the top of the chart and press "Show Data Box" or press down on the mouse wheel button to temporarily reveal the data box. The data box will display what the estimated stop ticks were for the price bar at that time. Being able to quickly check the estimated stop ticks has personally been a huge time saver for logging historical trades by JY Analytics.

The indicator was created for NinjaTrader version 8 and will not work for other versions or trading platforms.

CLICK HERE TO DOWNLOAD INDICATOR

This indicator has a 3 day trial that is automatically managed without a need for registration or machine id.

Single charge of $50.00 USD.

The price is for one license on one computer at a time. Additional computers require additional licenses.

After buying the indicator please email your NinjaTrader assigned "Machine ID" to indicators@jy-analytics.com

To find your "Machine ID" open NinjaTrader then go to Control Center, click Help, then click About. It is the 5th line down.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.

Risk Disclosure: Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones' financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure: Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.